Economic Outlook

Economy

Over the past year, the global economy has been gradually slowing, yet remains resilient because of a robust labour market. This trend of gradually slowing global growth is likely to continue although the downside risk will increase if global trade tensions escalate significantly. Heading into 2025, there has been a divergence within developed market economies where the manufacturing sector has been sluggish but overall growth has been supported by strong services activity.

The global economic outlook for 2025 is heavily dependent on the policies implemented by United States (US) President-elect Donald Trump. With the Republican party securing a clean sweep of control of the US Senate and House of Representatives, President-elect Trump may be emboldened in pushing through his policy priorities. Nonetheless, it is important to understand that President-elect Trump’s implemented policies may differ from his campaign policy pledges.

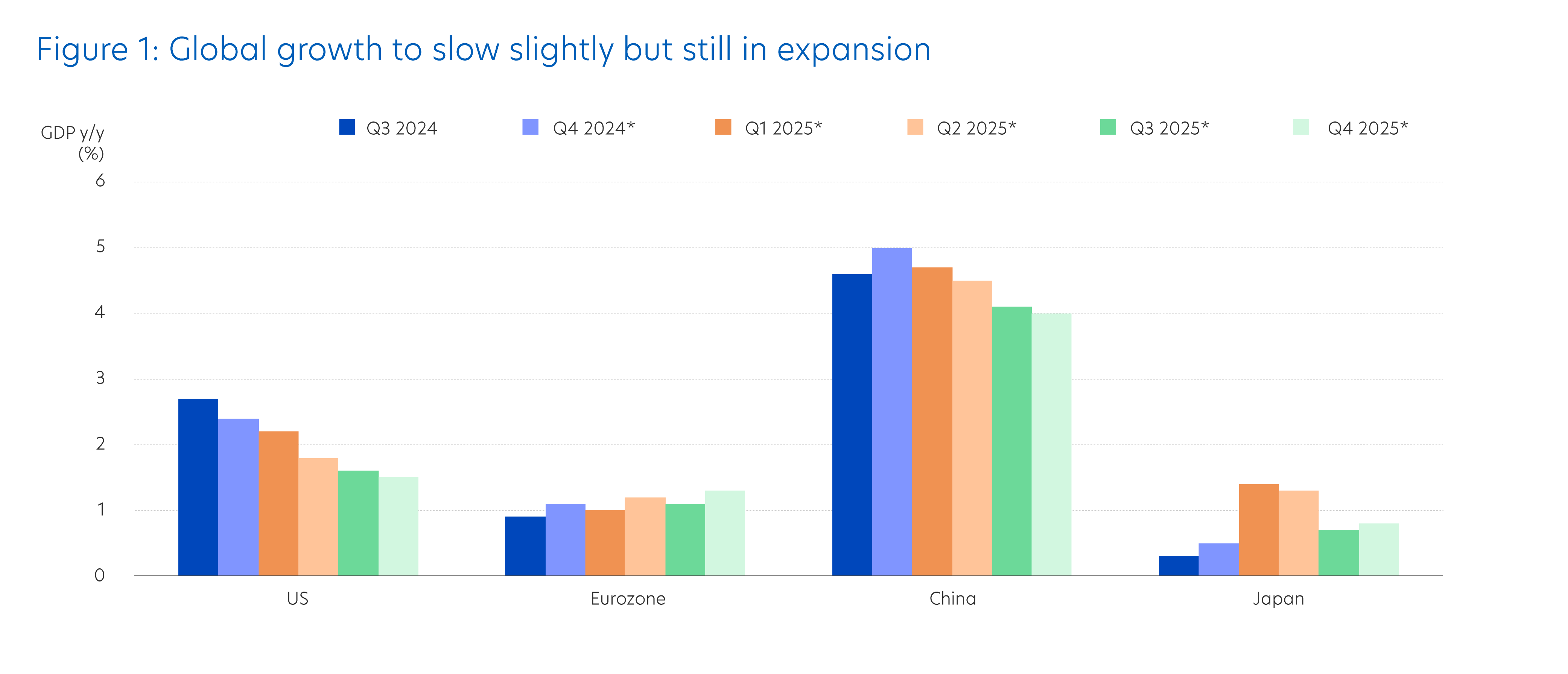

Based on what we currently know about Trump’s policy priorities, an economic growth divergence may emerge this year where the US economy outperforms global peers over the coming quarters (Figure 1). The laggards will be countries most affected by trade tariffs.

* Data is forecasted by UOB.

Source: UOB Global Economics & Market Research, Bloomberg (30 November 2024)

Pro-growth policies like tax cuts and deregulation are expected to further support the US economy which has been underpinned by resilient consumer spending. That said, consumption may slow slightly over the coming year.

In the near-term, global exports will likely be supported as companies rush to front-load shipments ahead of potentially new trade tariffs imposed by the US. As the year progresses, the trade outlook will become less certain, and tariffs may end up casting headwinds for export-reliant economies.

The biggest risk for the global economy is tit-for-tat trade restrictions. While we believe President-elect Trump will use the tariff threat as an opening negotiation ploy to yield concessions from trade partners, his first term highlights that investors should be mindful of a deterioration in global trade relations. Other risks to consider are ongoing geopolitical conflicts, political gridlock in some countries, China’s growth slowdown, and extreme weather patterns.

Inflationary pressures have eased over the past two and a half years, reducing input costs for businesses and easing the cost-of-living squeeze on households. This has allowed many global central banks to turn their focus towards economic growth risks by cutting interest rates. Looking ahead, the risk is that tariffs imposed by the US may cause inflation to re-accelerate, so rate cuts may be cautious and more gradual over this year.

The Chinese economy will continue to face challenges ahead. Over the past year, it has been propped up by export demand stoking a manufacturing recovery, offsetting headwinds caused by a weak property market and sluggish domestic consumption. As trade tensions with the US looks likely to increase in the coming year, it is increasingly important that domestic consumption stabilises and supports economic growth. This will require significant fiscal and monetary stimulus from the government.

The outlook for other Asian economies will depend on China’s growth path and the scale of US tariffs. ASEAN economies may see heightened scrutiny due to its rising trade surplus with the US, but a continued increase in foreign capital investments, a large and young population base, and stable political environment are positive factors.

Inflation

Since the middle of 2022, inflation has been slowing, and in most countries, it has converged towards the 2% level targeted by most central banks.

While this was expected to continue for the coming year, the inflation slowdown may falter if services prices stay elevated. Unusual weather patterns also have a negative impact on global agricultural commodity supply, potentially leading to higher prices.

We now also need to factor in the inflationary impact of certain policy priorities of US President-elect Trump.

For the US, an extension of individual tax cuts will support consumption demand, preventing a drastic slowdown in inflation. New import tariffs imposed by the Trump administration will potentially mean higher end-prices paid by American consumers, causing inflation to re-accelerate in the US. Trump’s immigration policy proposal of large-scale deportation could lower the workforce number, leading to higher wages, and consequently higher inflation.

As for the rest of the world, an escalation of trade tensions will affect global supply chains, potentially resulting in higher prices.

While we await President-elect Trump’s policy implementation, the outlook calls for stable inflation (Figure 2) but we acknowledge there are greater upside risks for inflation in the year ahead.

* F and dotted lines represent yearly average consumer preice index (CPI) forecasted by UOB.

Source: Bloomberg (30 November 2024)

Central Bank Policies

Over the past year, the slowdown in inflation has allowed many central banks to shift their focus towards supporting economic growth. This is evident in the increasing number of central banks that have cut interest rates recently.

Encouragingly, these rate cuts are not because of recession concerns but represent a fine-tuning of monetary policy to reflect the current inflation and growth outlook.

For 2025, the path of global monetary policy will be heavily dictated by both the economic and inflationary impact of US President-elect Trump’s policies.

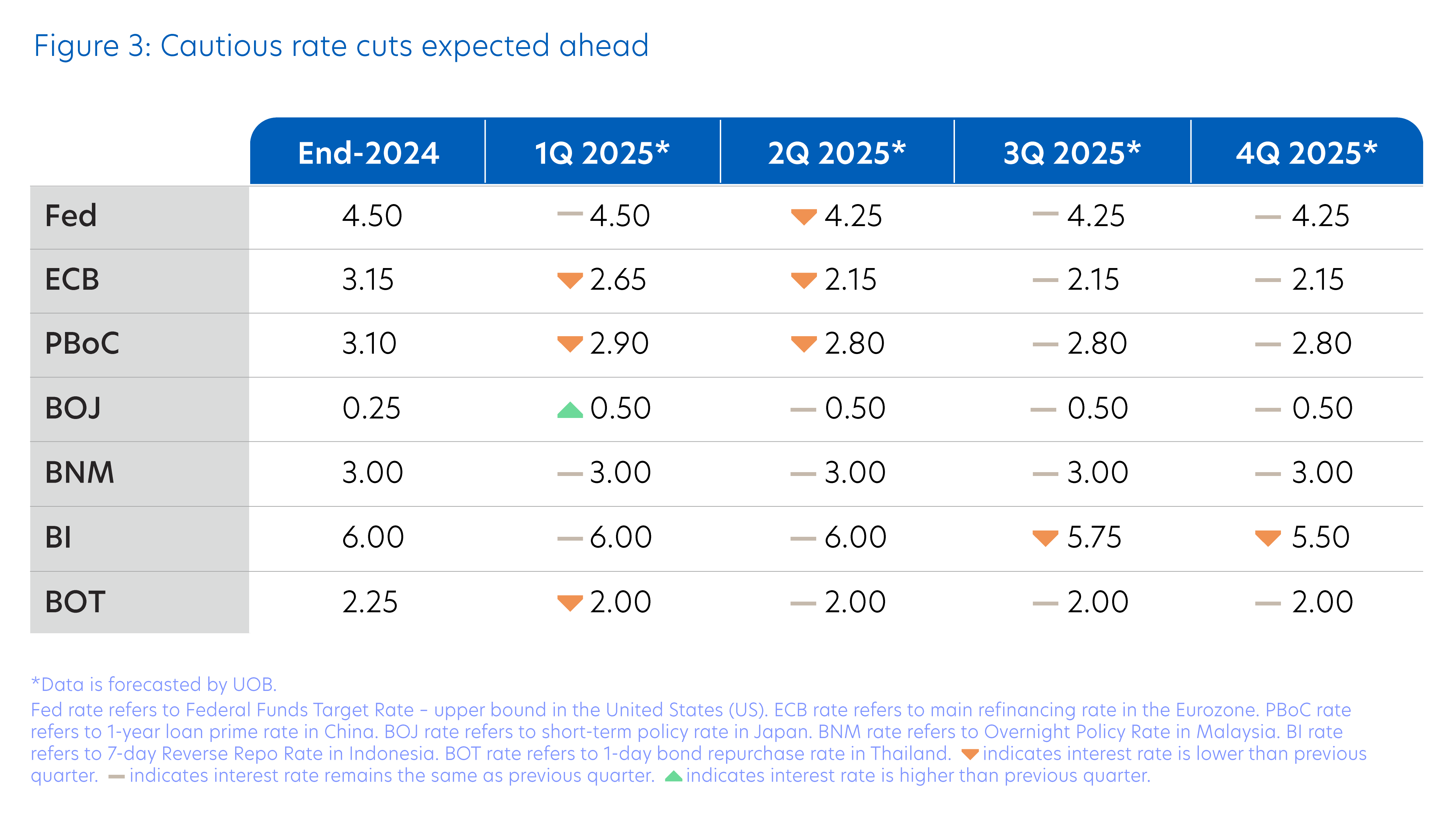

The outlook is for cautious rate cuts ahead, and the magnitude and pace of rate cuts will vary across global central banks because different economies will be affected differently by US policies (Figure 3).

Source: Bloomberg, UOB Global Economics & Market Research (13 January 2025)

We expect the US Federal Reserve (Fed) to deliver only one 25 basis points (bps) rate cut in the second quarter of this year because the US labour market has proven to be more resilient than expected while US President-elect Trump’s tariff policy could cause inflation to re-accelerate. Thereafter, we expect the Fed to keep interest rates on hold for the rest of 2025.

Given economic weakness and a quicker slowdown in inflation, we expect the European Central Bank (ECB) to bring forward 100 bps of rate cuts to the first half of this year, via 25 bps reductions in January, March, April and June. This will lower the deposit rate to a neutral level of 2% by the end of the second quarter of 2025. If rising trade tensions dampen Eurozone exports and economic growth by more than currently expected, the ECB may have to react with even more rate cuts.

China has announced it intends to pursue a “moderately loose” monetary policy strategy to support an economy facing both domestic and foreign headwinds, suggesting more rate cuts ahead. That said, China faces limits on how much it can cut interest rates as potential capital outflows could drive depreciation pressure on the Chinese Yuan (CNY). Instead of aggressive rate cuts, we think China’s central bank (PBoC) will focus on reducing banks’ reserve requirement ratio![]() (RRR) by another 50-100 bps this year. We also expect a 30 bps cut in total to the benchmark 7-day reverse repo rate

(RRR) by another 50-100 bps this year. We also expect a 30 bps cut in total to the benchmark 7-day reverse repo rate![]() and also the 1-year and 5-year loan prime rates

and also the 1-year and 5-year loan prime rates![]() (LPR).

(LPR).

Despite muted inflation across the region, other Asian central banks are likely to stay cautious. While potential growth headwinds caused by US tariffs may warrant rate cuts, Asian central banks could refrain from aggressive moves given concerns over currency weakness and capital outflows.

Japan is likely to remain the outlier as the only major central bank raising interest rates, although we expect only one more rate hike early this year before interest rates are held steady.

We acknowledge risks to our interest rate outlook. If trade tensions result in tit-for-tat retaliatory tariffs and countries prioritise a policy of onshoring supply chains, a re-acceleration of inflation in some countries and weaker economic growth in other countries could result in a desynchronised path for global interest rates.

Country Focus

United States

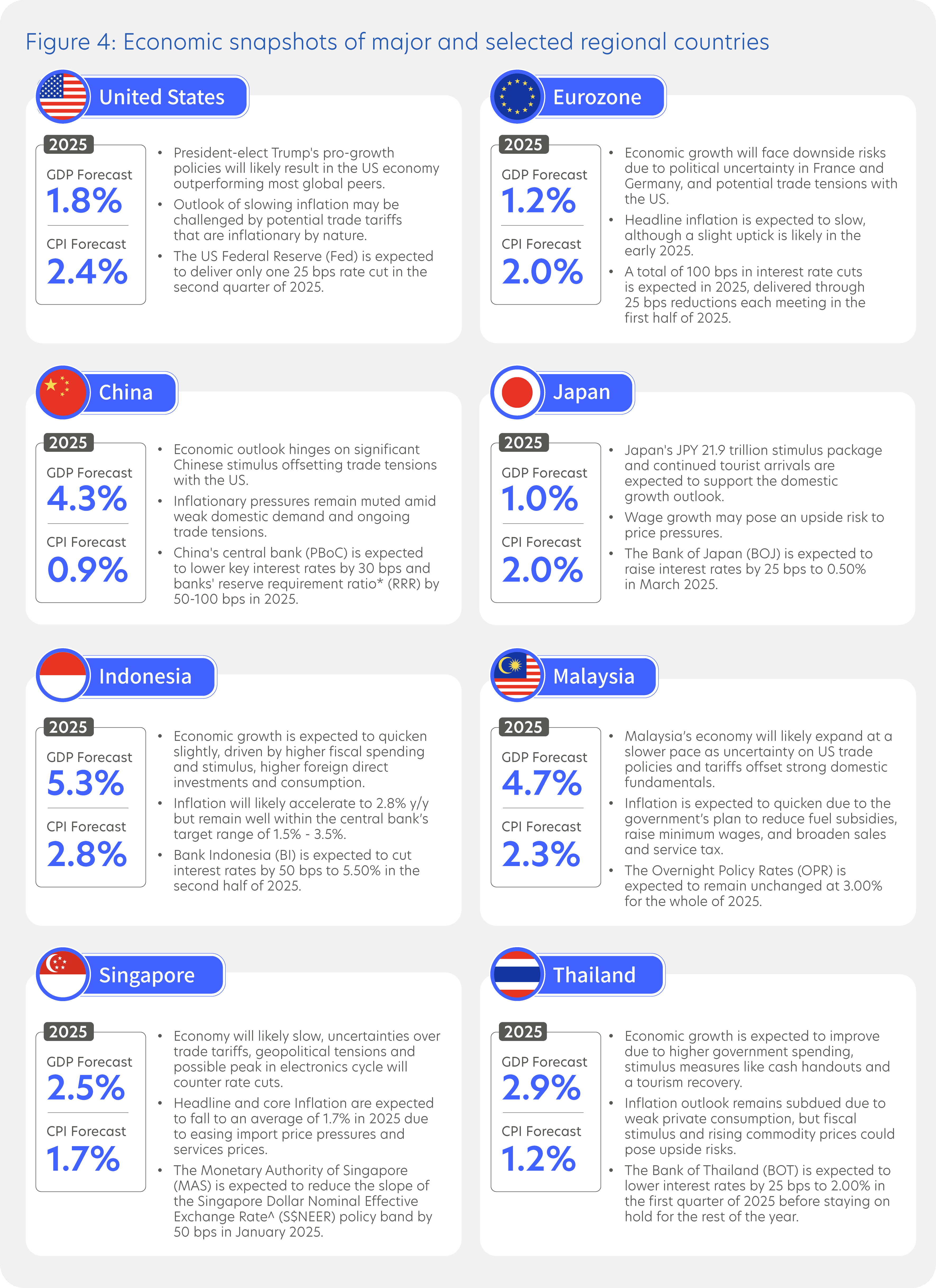

The United States (US) economy has proven resilient over the past year, underpinned by a robust labour market and strong domestic consumption. In comparison to its developed market peers, the US economy outperformed in 2024.

For 2025, we expect US economic outperformance to continue because of President-elect Trump’s pro-growth policies like tax cuts and deregulation. Such policies are expected to boost business confidence, corporate expansion plans, consumer spending and investment sentiment.

That said, there will be a lag to the fiscal boost as implementation of fiscal policy may only happen in the second half of the year. In addition, tougher immigration policies may also affect labour supply, business plans, and overall economic activity. Heightened trade tensions may also affect global supply chains and negatively affect economic productivity.

While US domestic consumption remains strong, consumers in the lower-middle income brackets are starting to be more price conscious in their purchases. This will be even more apparent if tariffs are raised ahead. We also expect the US unemployment rate to edge up further to 4.5% by the end of this year.

Considering all the above factors, we expect 2025 US gross domestic product (GDP) to slow to 1.8%, though still resilient. This is however dependent on the scale and timing of President-elect Trump’s policies.

While we expect headline inflation to slow to an average of 2.4%, we acknowledge upside inflationary risks posed by Trump’s policies.

We expect the US Federal Reserve (Fed) to only deliver one 25 basis points (bps) rate cut in the second quarter of this year. Thereafter, we expect the Fed to keep interest rates unchanged for the rest of the year, leaving the upper bound of Federal Funds Target Rate (FFTR) at 4.25%.

Eurozone

The Eurozone economy faces downside risks in the year ahead. This is due to the simultaneous growth slowdown and political uncertainty in Germany and France. This means the two biggest European economies may not be able to support regional growth. Beyond this, a potential escalation in trade tensions with the US also complicates the Eurozone economic outlook, particularly for exporters. US President-elect Trump has already threatened the European Union with tariffs if its member countries do not buy more American oil and gas to lower their trade deficit with the US.

For now, European labour markets remain strong with the Eurozone unemployment rate at a record low of 6.3%. While wage growth has been elevated, we expect this to ease over the coming year in response to a weaker economy. Given weakening growth prospects and with inflation set to slow further, we expect the European Central Bank (ECB) to bring forward pre-emptive interest rate cuts into the first half of the year. We expect 25 bps rate cuts at each of the next four policy meetings, January, March, April, and June, to bring the deposit rate down to a neutral level of 2% by the end of the second quarter of 2025. The ECB will likely keep monetary policy unchanged for the second half of the year.

That said, we acknowledge that if rising trade tensions dampen Eurozone exports and economic growth by more than currently expected, the ECB may have to react with even more policy easing.

China

China’s economy will likely face significant challenges this year due to property market weakness, sluggish domestic consumption and potential trade tensions with the US. Provincial government finances remain stretched while long-term relocation of supply chains caused by US trade policy may also undermine China’s domestic manufacturing activity.

The key uncertainties lie in the timing and scale of US tariffs, and the magnitude and effectiveness of China’s stimulus measures.

On its part, the Chinese government has signalled a greater urgency to support the domestic economy in 2025. The first steps came via a series of stimulus announcements at the end of September 2024. This was followed by the unprecedented strong signal of substantial monetary and fiscal stimulus issued at the 9 December 2024 Politburo meeting.

Notably, China’s Politburo announced it will pursue a “moderately loose” monetary policy strategy for the first time since the Global Financial Crisis, as compared to the “prudent” policy strategy that has been in place since 2011. China’s top leaders also signalled that fiscal policy will be “more proactive”, a hint that fiscal spending will increase in 2025. In addition, Beijing pledged to stabilise the property and stock markets and use more policy tools to boost the economy.

This hints at further rate cuts, a higher budget deficit target closer to 4% of GDP than the implicit ceiling of 3% that will enable greater fiscal spending and asset purchases next year.

In the near-term, China’s export volumes should remain buoyant but the outlook is less clear as the year progresses if US tariffs are imposed.

China’s strong signal of substantial monetary and fiscal stimulus is unprecedented, but stimulus pledges will need to be followed up with concrete measures. It remains to be seen if actual stimulus measures will be significant enough to generate a sustained recovery in domestic consumption which appears to be a key priority for China in 2025. A focus on expanding domestic demand and consumption, and ending deflation will be increasingly important if trade tensions with the US rises.

We expect China’s 2025 economic growth to slow slightly to 4.3%, although more punitive US tariffs will pose downside risks to this projection.

Investors have ramped up expectations of additional monetary easing by China’s central bank (PBoC) to support the economy against increasing headwinds. However, potential capital outflows driving depreciation pressure on the Chinese Yuan (CNY) means there are limits to how much China can cut interest rates. We think the PBoC will focus on reducing banks’ reserve requirement ratio (RRR) to release long-term liquidity into the financial system and expect another 50 to 100 bps of RRR cuts this year. We also expect a 30 bps cut in total to the benchmark 7-day reverse repo rate and also the 1-year and 5-year loan prime rates (LPR).

Japan

Japan’s economy is likely to be supported by an expected consumption recovery driven by higher wage growth. This will be aided by continued tourist arrivals driving tourism revenue, and accelerated capital investments into semiconductor technology.

The recently approved JPY 21.9 trillion stimulus package will also support wage growth and help households cope with higher prices.

Nonetheless, there are external risks posed by potential trade tensions and China’s growth slowdown, while domestic risks stem from a continuation of weak domestic consumption.

While we expect Japan’s economy to grow 1.0% this year, this has been revised lower from the previous projection of 1.7%.

Japan’s inflation has held above 2% since April 2022, but we expect both headline and core inflation to ease down to 2% this year.

Japan has been the outlier where their 2024 policy tightening focus was in response to above-target inflation and higher wage growth. We expect Japan’s central bank (BOJ) to raise interest rates by 25 bps to 0.50% in March before keeping rates unchanged for the rest of the year due to external headwinds and domestic political uncertainty. However, there is a possibility the rate hike may be delayed until April or even later as the BOJ may want to gain clarity of US policies and Japan’s wage growth trend.

GDP is gross domestic product. CPI is consumer price index.

*The Reserve Requirement Ratio is a monetary policy tool used by the PBoC to regulate the amount of money commercial banks must hold in reserve.

^Singapore Dollar Nominal Effective Exchange Rate (S$NEER) is a policy tool used by the MAS to manage the exchange rate of the Singapore Dollar.

Source: UOB Global Economics & Market Research (13 January 2025)

Asset Class Views

Stocks

The outlook for global stocks remains positive as the global economy continues to expand while corporate earnings remains resilient.

Nonetheless, periods of market volatility may be seen owing to uncertainties over United States (US) policies and the interest rate outlook. Stock market returns may vary for different countries, which will offer different opportunities for investors. The focus should be on economies and sectors with less export dependence on the US.

Looking broadly at global stocks, we favour investments in quality dividend stocks as dividend payouts will remain attractive due to strong balance sheets and cash flows. We also have a positive outlook for developed market financials and the technology sector.

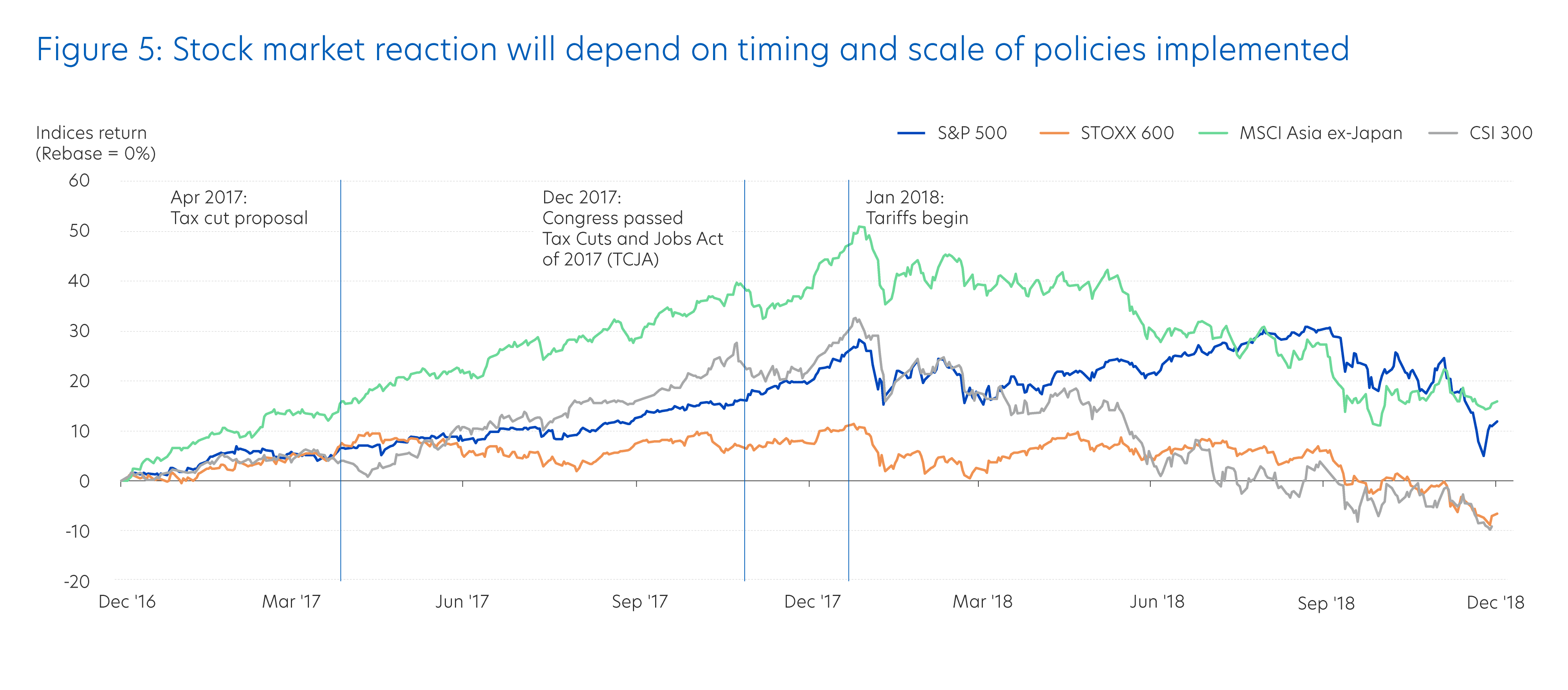

A discerning approach is however required as certain markets and sectors will be impacted differently depending on the scale of policies implemented by US President-elect Trump. Drawing reference from Trump’s first term between 2017-2020, the expectation of tax cuts triggered a sharp rally in US stocks across 2017 while the imposition of trade tariffs saw Chinese stocks underperform during 2018 (Figure 5).

S&P 500 index used as benchmark for US stocks. STOXX 600 index used as benchmark for European stocks. MSCI Asia ex-Japan index used as benchmark for Asia ex-Japan stocks. CSI300 index used as benchmark for China stocks.

Source: Bloomberg (30 November 2024)

One thing to be mindful of is that US President-elect Trump may implement both tax cuts and tariff policies concurrently this time, so the stock market’s trend may not be as distinct as seen in 2017-2018. Instead, concurrent policy shifts may result in phases of market volatility this year.

We hold a neutral outlook for US stocks as valuations are arguably stretched. Nonetheless, Trump’s pro-growth policies like tax cuts and deregulation will support US corporate earnings, while the US economy is set to outperform global peers. That said, US stock market returns are unlikely to be as strong as that seen in 2023 and 2024. In recent years, US mega-cap technology stocks have contributed disproportionately to broad index returns. In 2025, other US stocks outside of these mega-caps will likely catch up due to less expensive valuations and more domestic exposure, offering potential for better returns.

Trump’s policy priorities will likely benefit US financials and the tech sector. For the US tech sector specifically, Trump's policies could encourage fresh research and development (R&D). Artificial intelligence (AI) innovation continues to power the technology sector, but sector leadership will eventually broaden out from mega-cap companies to other software companies.

Beyond this, quality US companies in economically sensitive sectors will benefit from the US’ economic resilience. US small-cap stocks will also face less headwinds due to domestic-focused businesses.

The outlook for European stock markets is uncertain despite likely rate cuts by the European Central Bank (ECB). This is due to the Eurozone’s weak economic momentum while potential trade tensions with the US and China may darken the export outlook. To unlock Europe’s growth potential, policy shifts or structural reforms are required but this may not be forthcoming due to political turmoil in Germany and France. As such, though European stock valuations are significantly lower than US peers, we retain a neutral outlook for European stocks. given potentially weaker corporate earnings growth.

The outlook for Asian stock markets is mixed. While potential trade tensions and China’s uncertain economic recovery will weigh on Asian stock market sentiment, there are certain positive factors. Asia ex-Japan stock valuations remain attractive, corporate earnings will likely stay robust, while potential fiscal stimulus by China may also mitigate some downside risks. Export-reliant companies will face headwinds, while Asian companies that are less reliant on external trade and focuses more on domestic-oriented businesses may fare comparatively better across this year.

For Chinese stocks, sectors that may do comparatively better are those deemed strategic by the government, defensive stocks, domestic-oriented companies, and sectors offering high dividend payouts.

Knowing this, investors should be agile and proactive in their exposure to Asian and Chinese stocks. A market neutral strategy designed to potentially generate returns regardless of whether the market goes up or down will allow you to seize opportunities and lower portfolio volatility. Quality Asian dividend stocks also offer attractive income.

ASEAN will continue to benefit from ongoing supply-chain diversification, regional policy coordination and stable politics. For exposure to ASEAN stocks, investors should consider a diversified exposure via funds. We also like Singapore stocks, which will continue to benefit from strong performance in bank stocks and attractive dividend yields from real estate investment trusts (REITs).

Bonds

The outlook for bond markets will depend on the state of the US economy and US President-elect Trump’s policies. Over 2024, the yield differential between US investment grade bonds and high-yield bonds narrowed significantly, indicating investors’ willingness to allocate capital to riskier bonds as the resilient economy kept default risks low.

In the short term, global bond markets may see increased volatility and bond yields may stay elevated given the inflationary impact of potential trade tariffs.

An acceleration in US fiscal spending may worsen the country’s fiscal deficit, which would entail greater bond issuance by the US Treasury Department. This outcome may be negative for US bonds.

Despite these risks, we continue to favour investment grade bonds because their attractive yields can build investment income over a long-term horizon. Investment grade bonds can also help investors guard against trade tensions and geopolitical uncertainties. As such, investment grade bonds will continue to play an important role of diversification in an investor’s portfolio.

Chinese bonds have risen sharply over the past year amid heightened expectations of significant rate cuts to support the domestic economy. While this trend is likely to continue in the short-term, we are mindful of the government intervening to cool the bond market rally.

Foreign Exchange and Commodities

Many are wondering whether a second Trump presidency will make the US dollar (USD) great again. This is far from certain, although foreign exchange rate volatility will rise.

We expect the USD to strengthen in the first half of this year as tariff uncertainties dominate. That said, we think USD strength will moderate in the second half of 2025 as the market prices in the tariff impact.

Asian currencies will likely weaken alongside the Chinese Yuan (CNY) for this year. This is because Asian currencies are more sensitive to tariffs and elevated US interest rates and will thus face a longer period of weakness as compared to major economy currencies.

We retain a positive view on Gold as safe haven demand will likely stay strong given geopolitical risks and potential trade tensions. In addition, consumer demand for physical gold and jewellery remains strong while emerging market central banks may continue to increase their Gold holdings. We expect Gold to rise to USD 3,000 per ounce by the fourth quarter of 2025.

The outlook for crude oil prices is negative given uncertainty over the global growth outlook and uncertainty over China’s demand. The supply outlook is also unfavourable with OPEC+![]() looking to ramp up oil production from April. This continues to nullify ongoing geopolitical risks. We expect Brent crude oil prices to fall to USD 70 per barrel in the second half of the year.

looking to ramp up oil production from April. This continues to nullify ongoing geopolitical risks. We expect Brent crude oil prices to fall to USD 70 per barrel in the second half of the year.

Credits

Credits

Managing Editor

- Winston Lim, CFA

Singapore and Regional Head,

Deposits and Wealth Management,

Personal Financial Services

Editorial Team

- Abel Lim

Head of Wealth Management Advisory and Strategy,

Deposits and Wealth Management,

Personal Financial Services

Editorial Team (cont’d)

- Tan Jian Hui

Wealth Management Advisory,

Deposits and Wealth Management,

Personal Financial Services - Low Xian Li

Wealth Management Advisory,

Deposits and Wealth Management,

Personal Financial Services - Zack Tang

Wealth Management Advisory,

Deposits and Wealth Management,

Personal Financial Services

Important notice and disclaimers

The information contained in this publication is given on a general basis without obligation and is strictly for information purposes only. This publication is not intended to be, and should not be regarded as, an offer, recommendation, solicitation or advice to buy or sell any investment or insurance product and shall not be transmitted, disclosed, copied or relied upon by any person for whatever purpose. Any description of investment or insurance products, if any, is qualified in its entirety by the terms and conditions of the investment or insurance product and if applicable, the prospectus or constituting document of the investment or insurance product. Nothing in this publication constitutes accounting, legal, regulatory, tax, financial or other advice. If in doubt, you should consult your own professional advisers about issues discussed herein.

The information contained in this publication, including any data, projections and underlying assumptions, are based on certain assumptions, management forecasts and analysis of known information and reflects prevailing conditions as of the date of the publication, all of which are subject to change at any time without notice. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, United Overseas Bank Limited (“UOB”) and its employees make no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for its completeness or accuracy. As such, UOB and its employees accept no liability for any error, inaccuracy, omission or any consequence or any loss/damage howsoever suffered by any person, arising from any reliance by any person on the views expressed or information contained in this publication.

Any opinions, projections and other forward looking statements contained in this publication regarding future events or performance of, including but not limited to, countries, markets or companies are not necessarily indicative of, and may differ from actual events or results. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. Investors may wish to seek advice from an independent financial advisor before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider whether the investment or insurance product in question is suitable for you.